Author: Yang Liu

Editor’s Note

In 2018, the venture capital industry saw a whirlwind race towards the heavens. Only this time, it is less a race to become the next unicorn. Instead, this is a race to see who can build the fastest spacecraft to touch the skies – and allow humanity to reach its final frontier: Space. In this article, we will analyze this burgeoning industry. We hereby exclusively present Source Code Research Report Issue No. 16.

Viewpoints

- Rockets are the only basic means of transportation to space. Not only do they enable expansion of space-related applications, they further stimulate diverse space-related businesses and technological advancements.

- Different models and technical directions are better suited for different market segments, and start-ups should plan their product iteration paths in combination with current technology additions and targeted customer needs. It is not conducive for companies to single-mindedly focus on single product, or specific R&D pursuits that facilitate only single or narrow applications.

- Rocket launching is a long-distance competition that requires companies to have high endurance in order to be able to compete in this long-term race. The core team must be focused, stable, and capable. They must accurately grasp customer needs and deliver highly reliable as well as low-cost products.

- There is still a 1-2 years window in which companies can keep testing different flight models. During that period of time, there is still a chance for companies with unique competences and talents to join in the race and make a difference.

Industry Market Observations

1. How big is the market size?

First, let us take a look at spacecraft launches in the recent years and the evolution of the market. From 2012 until 2018, each year, 70 to 114 spacecrafts were put onto orbit. The average cumulated annual value of those launches is estimated to be USD $5-6 billion. For 2018 alone, 476 satellites were sent in space. During this same period, China launched 15-22 spacecrafts per year before the number of launches suddenly rapidly ascended to reach 40 launches in 2018.

Judging from the historical data alone, the spacecraft launch market does not seem particularly remarkable, but these spacecrafts not only represent the basic means of transportation to space. They, in fact, provide increased benefits in space-related appliances, and further stimulate additional market applications through technological innovations. With a bit of imagination, let’s now take a deeper look into the future of this potential market:

1) On-Orbit delivery service: According to available statistics, from 2018 to 2025, 20,000 satellites are expected to be put on orbit. China itself, through its Top10 Constellation Program, plans to launch more than 2,000 new satellites. As of now, given that the launcher capacity is still very limited, the commercial on-orbit delivery service will likely become of the most competitive sector in the coming years.

(We note that available statistics may yet be incomplete as the industry is still developing.)

2) High-speed flight: A relatively new application, focused on the domestic aerospace and developed by different research institutions. Between 1959 and 1968, the United States conducted 199 flights under the X15 Research Program, which focused on high hypersonic speed (above Mach 5). In 2016, the HyRAX reusable hypersonic test vehicle program was released in order to further mature current technologies, and reduce the current risks of high-speed flight.

In the past, similar tests were conducted in China with wind tunnels, but the experiments were very expensive and only partial data could be collected. The size of the domestic market is currently estimated to be RMB 500 million to RMB 1 billion annually. However, only very few companies can provide hypersonic flight experiment and reusable launch systems.

3) Space tourism: This refers to short-distance travel such as sub-orbital flight or long-distance travel that could potentially carry people to the moon. This market is more difficult to predict. For example, Antarctic tourism represents around 3-4 million people every year, for an average cost per client of RMB 5-10 million.

- Virgin Atlantic sub-orbital space travel. At the end of 2018, SpaceShipTwo spaceship flew to the edge of space twice and returned smoothly. This travel service is expected to start operating in 2020. Each ticket costs USD $250,000 and as for now, Virgin Galactic is reported to have sold more than 600 tickets, which shows the popularity of space travel.

- The New Shepard spacecraft developed by Blue Origin is also trying to develop its sub-orbital travel business.

- SpaceX’s Big Falcon Rocket will launch its first private mission around the moon. Japanese billionaire, Yusaku Maezawa, is expected to be the first private passenger to travel to the Moon and back.

4) Point-to-point loading / carrying: With the maturation of reusable rocket technology, Elon Musk proposes to use the newly developed BFR for non-orbiting ballistic flight in the future. From the launch pad to another launch pad on the other side of the Earth within one hour, Musk estimates that the price of a seat on one of these flights should be similar to that of an economy class ticket on a conventional aircraft for the same distance.

5) Sounding rockets: Atmospheric exploration and scientific experiments in the near-Earth space like detecting structural components of various layers of the atmosphere and/or studying a variety of physical phenomena. This includes studying the ionosphere, geomagnetic storms, cosmic rays, and solar ultraviolet radiation. It is a high-flying, low-orbiting artificial satellite with effective detection tools for altitudes comprised of between 30 kilometers to a maximum of 200 kilometers. The annual value created by the spacecraft of Zhongtian Rocket Technology is around RMB 50 million to RMB 100 million.

2. What changes have occurred in the market?Is there a chance for a new company?

1) Policy guidance: The backdrop of the National Strategy for Civil-Military Integration provides a better policy environment for China’s commercial space companies. This includes a better supply chain, test and launch sites, faster approval processes, and even institutional orders to provide better support to the industry. This is similar to the United States in the 1990s, when Boeing, Lockheed Martin and other private companies were heavily subsidized. Later on, competition was introduced, and support given to several space start-up companies, including SpaceX, Blue Origins, and Sierra Nevada Corporation.

2) Technical direction: Customer needs and demands have evolved as well, shifting from a large satellite weighing several tons, to smaller satellites weighing tens of kilograms, to a few hundred kilograms, which has encouraged the emergence of new small launch engines market. In the meantime, reusable launchers and technologies have reduced the costs of operation, thus stimulating even heavier competition.

3) Talent flow: The past 60-years of continuous development in China’s aerospace industry has resulted in the formation and accumulation of a large number of skilled personnel. Moreover, since 2015, the rapid growth of commercial space companies has gathered a great deal of energy and creativity, a tendency that is still on the rise. As the income of aerospace workers increases, more qualified students will likely choose to join the industry in the future.

4) Foreign benchmarking: U.S. star companies such as SpaceX have demonstrated how private commercial space companies have grown bigger through new technological innovations and government collaboration. SpaceX is now valued at more than USD $20 billion.

The Industry’s Point of View: A Confrontation

The domestic commercial space flight market is just at its beginning. A lot of different approaches are bound to be swiftly seen in the industry. In this section, we are going to go through a few interesting core viewpoints.

1. Solid rocketversus liquid rocket

Liquid rockets are the mainstream model in today’s global space launch landscape, but solid rockets also play a very important role because of their own characteristics. As the liquid rocket model is already familiar to most, the emphasis here will be put on the advantages of the solid rocket model.

- The launch preparation period is short. As such as 11 launches can be achieved within 24 hours. By comparison, a liquid rocket launch usually takes about 7 to 20 days to complete, which includes multiple rounds of testing, general inspections, and propellant additions or adjustments.

- The storage cycle for solid rockets can be as long as several years, and it is non-volatile and non-corrosive, which makes it suitable for quasi-normalized emission. This offers certain advantages over the liquid rockets, as the liquid rocket propellant needs to be filled at the launch site. The storage period of the normal temperature propellant (such as nitrous oxide and dimethyl hydrazine) is about 7 days after the filling. After the low temperature propellant (such as liquid hydrogen or liquid oxygen) is filled, the post-storage period is only about 1 day.

Moreover, the storage period for solid rockets is long, up to several years without any volatilization or corrosiveness phenomena, and the launch process will not be altered by long storage period. On the other hand, liquid rocket propellants need to be injected on launch site, and the maximum storage period at the propellant normal temperature (e.g., nitrogen tetroxide and unsymmetrical dimethyl hydrazine) is about 7 days. For low-temperature propellants (e.g., liquid hydrogen, liquid oxygen) that storage period cannot exceed 1 day after injection.

- In addition, the carrying capabilities are actually very impressive, delivering high thrust power for a relatively low cost. That is why, the space shuttle and several heavy launch spacecrafts use solid propellant for boosters. For example, the ESA P120C has a maximum thrust capacity of 460 tons. China’s 200 tons large thrust solid rocket has also been successfully tested. In the future, the Long March No. 11 will be able to increase the SSO carrying capacity by no less than 1.5 tons.

- The development of the solid propellant rocket is also less difficult than the liquid propellant rocket. It is easier to develop and therefore a very viable option for countries or start-up companies with limited experience in the aerospace industry to consider.

Characteristics mentioned above show that solid rockets are often best suited in terms of maneuverability, and in terms of the launch schedules flexibility.

2. The big rocket (medium orheavy rocket)versus the small rocket

The large rocket and its heavy load capacity favors a few launches, carrying one large satellite or several smaller ones, as well as a crew ready to fulfill its mission. The small rocket is more suitable for flexible maneuvering with more launches, thus enabling the creation of a network of small satellites in no time.

In terms of cost, a large rocket will send a few small satellites or a big one in one launch, and the cost per kilogram of launching a new satellite is actually relatively low. However, we cannot calculate the launch cost by dividing it by the total carried weight. We also need to take into account the ability of the rocket to load a number of satellites, the rocket diameter, the fairing, the deployment of the satellites in space, and many other factors.

In the small satellites market, the biggest advantage of the big rocket is its ability to deploy in one launch a multitude of satellites, saving therefore time and energy.

The demand for the deployment of the smaller satellites network is increasing. The average life span of those smaller units is around 5 to 7 years. Growing demand, coupled with the necessity to replace broken satellites more often, will likely create hundreds of new additional requests every year.

3. Vertical landing versus Horizontal landing

Famous companies, such as SpaceX and Blue Origins, started the concept of the reusable launch system, which significantly reduced the cost of launching a spacecraft by being able to recover the first stage of that spacecraft and re-use it. There are two distinct reusable launch systems in the world.

From a technical point of view, the two methods do not differ much, with the main objective being to reduce operation costs through reusable technology. However, the key requirements for those 2 technologies are very different. At the moment, both the recovery (reusable) options are being delved into in China.

- In Vertical Landing (VL) technologies, the engine design is key, but it needs to be adapted to the overall rocket design. For example, during the returning phase, a large amount of fuel has already been consumed, making stage one of the spacecraft lighter, and therefore in need of only light thrust support to assure control during descent and a smooth landing. This also makes this type of engine easier to design and produce. Relatively speaking, adding 5, 7, or even 9 engines is easier to implement. As thrust power requirement is low during descent, only the main engine needs to be switched on.

- The problem of Horizontal Landing (HL) resides in the difficulty to predict an accurate landing location, which is due to the use of a parachute system. The distance travelled from the opening of the parachute to the landing is long, increasing therefore the risk of apparition of non-controllable factors. However, if the spacecraft was able to achieve controlled glide when using parachutes, the problem of determining an accurate landing location would be resolved.

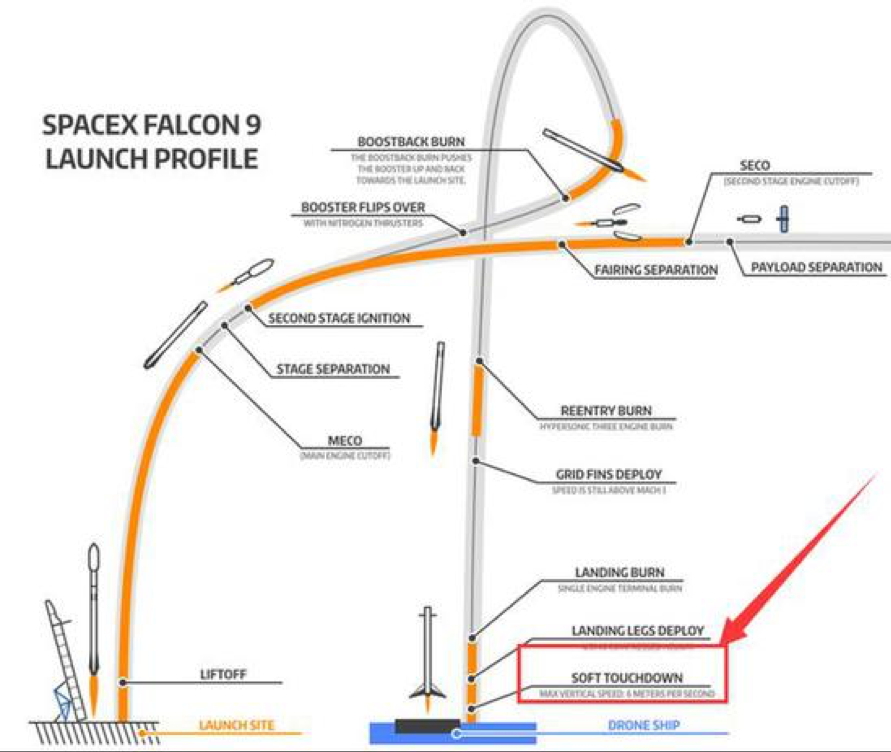

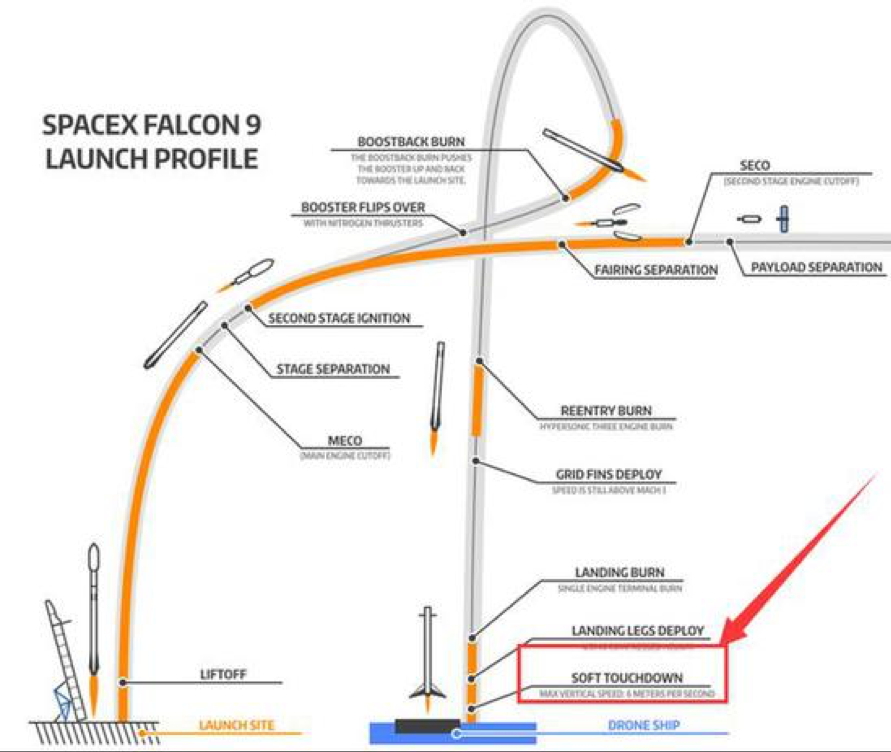

Figure 1 : Schematic of the SpaceX Falcon 9 vertical route

(Source: Internet Images)

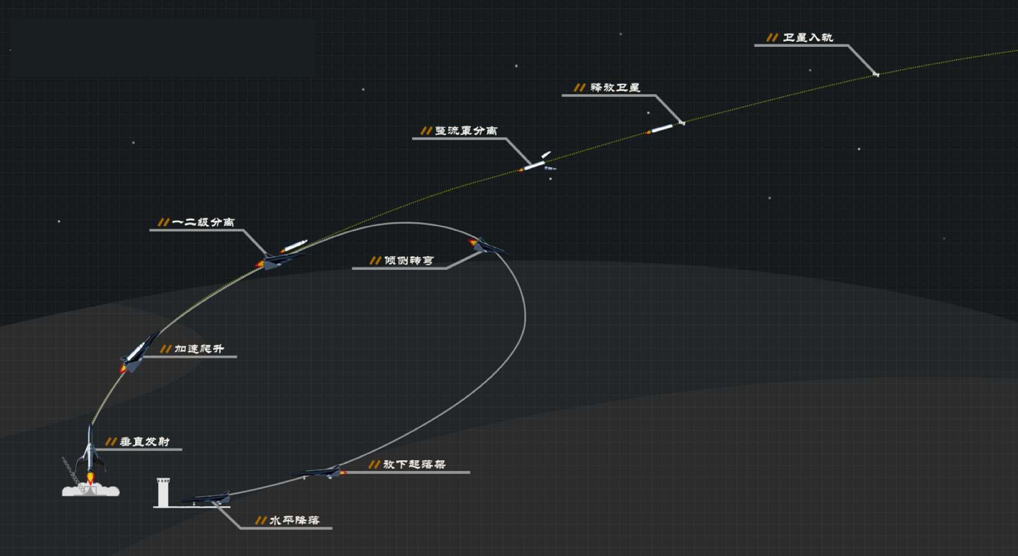

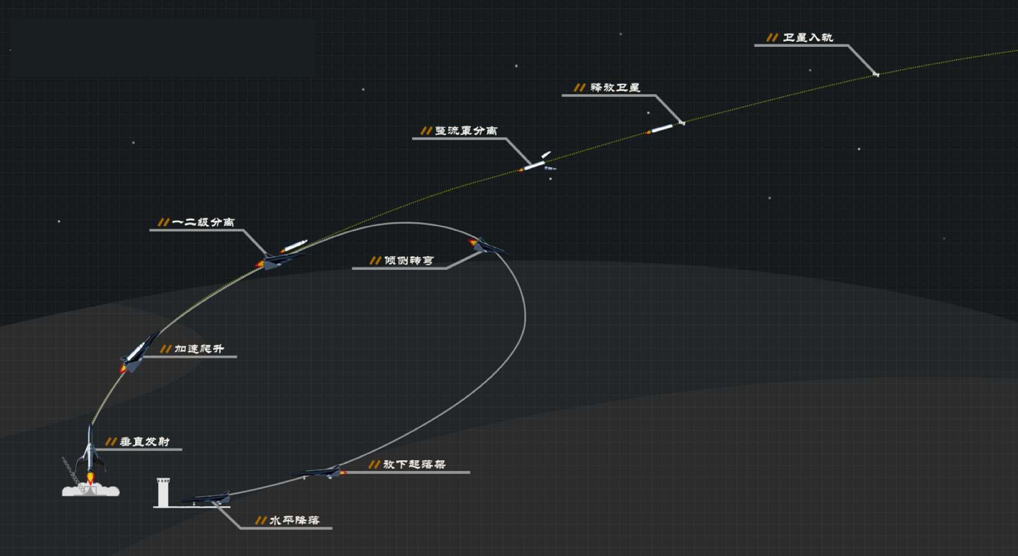

Figure 2 : Schematic diagram of horizontal route

(Source: Internet Images)

4. Liquid propellant choices:Liquid oxygen and methaneversus liquid oxygen and kerosene

“Liquid oxygen + kerosene and liquid oxygen + methane” are collectively referred to as the liquid oxygen hydrocarbon propellants. For many years, Russia and China have developed and refined the use of kerosene as their main propellant for rocket launches. Methane, however, has over the last few years received a lot of attention in the propellant research. It is difficult to say which is better as their uses differ widely according to rocket designs, technical capabilities, and application scenarios.

- In terms of physical properties, the vacuum ratio of methane is slightly higher than that of kerosene by around 10 seconds; however, the density of methane is lower. At the same mass, its volume is smaller, and its overall density ratio is lower than that of kerosene. In terms of combustion, when used as rocket propellants, the efficiency of methane is not necessarily better than that of kerosene.

- The real benefits of methane lie in its high coking temperature and in its relatively low carbon deposition. It is better suited for engines with multiple combustion stages. Its high combustion ratio allows it to achieve higher specific impulse ratios with less design difficulties, as well as allowing longer engine lifespan. As for now, Chinese commercial spacecraft companies use gas generator cycles and do not yet have the ability to develop graded combustion engines.

- In reusable launcher technologies, both propellants are supported. The SpaceX Falcon Rocket’s Merlin engine has proven that liquid oxygen kerosene can use an enriched oxygen environment to suppress coking problems, and therefore be used in reusable rockets. Repair costs after the recovery process may be slightly higher, but the difference is actually not that high.

- The development of similar grade methane engines is relatively more difficult. There is currently no fully completed methane engine. Therefore, it will take longer to achieve, as it will require more testing and approvals before it can be ready to take off.

5. Self-developed engines versuspurchased engines

The engine is one of the core components of the rocket. In the long run, it is a key technology and an important process that the spacecraft companies need to master. It does not mean that it should be its sole focus though. The rocket’s reliability, the launch preparations cycle, as well as its costs, are still one of the most important considerations when it comes to choosing a company.

Purchasing engines is a very common practice in the commercial space industry. Acquiring an engine that has been tested and fired multiples times, instead of building one from the ground up, might be the best option for a start-up company.

The Chinese rocket engine market has also gradually improved. The ban on small solid engine sales has been progressively lifted, opening up the possibility for potential sales of liquid engines in the future. At the same time, many companies are conducting their own research and the development of engines, and soon might sell their own products. The future is in the rocket engine suppliers market.

On that note, as the number of spacecraft launches soar, will the rocket industry chain be split up in future? Will we see a division of labor such as in aircraft companies like Boeing or Airbus, or in aero-engines companies like GE, Rolls-Royce, Pratt and Whitney?

6. Financing stage/Creation time: Tier 1 companies versus tier 2 companies

The rocket launch business is a long-distance race, and the pre-stage development of technologies, with all its trials and errors, can be quite time consuming. Although several companies were established early and have a clear lead in terms of the size and financing, it is difficult to say if the battle has already been won. After all, there is still a minimum 1 to 2 years window in which the main design (model) of those companies need to be tested and officialized. The different and various technical and strategic options mentioned earlier will certainly, to some extent, affect the R&D cycle. Therefore, there are still opportunities for tier 2 companies to catch up and even maybe beat tier 1 companies.

Potential Emerging New Company Models

What special qualities are likely to make a difference in the rocket launch market race?

1. A competent and stable core team

Since it is a long-distance race, R&D, testing, product and technological verification, as well as approvals, will take a long time. Because of this long timeline, the need for continuity and stability in the team is fundamental. This requires founding partners to have enough experience and strength in order to keep the team united. It calls for steady, persistent, and sustained business growth for the company.

Spacecraft companies need to have four major areas of focus: the overall design, control, power, and launch. The overall design and control process must have a strong technical direction to define a suitable and reliable rocket product from the get-go. Power and launch are very important and will need to be addressed in a timely manner according to the company’s medium- to long-term product development route.

2. Highly reliable and low-cost rocket products are a possibility

High reliability is the one of the most important indicators when it comes to rocket launches. On the one hand, it involves the long design maturation process as well as the constant refinement of the technology used. On the other hand, it requires multiple launches to ensure the continuous training of both technical and engineering teams. For emerging commercial spacecraft companies, it is fundamental to take on all the opportunities to build a highly reliable reputation, premium brand, and strong references.

Low cost is the future direction for commercial rocket companies. At the present, there are four main directions:

1) Reduce supply chain costs: replace institutional or state-owned supply chainswith private industrial systems;

2) Reduce production costs: mass production of industrial production;

3) Increase the number of uses and lifespan of products: reusable technology;

4) Reduce launch costs: big liquid engine single launches carrying multiples satellites or multiple small solid engine launches.

Where A and B are the main focus for all private spacecraft companies, C and D are the keys to competitiveness, and focusing on even a single one of them is likely to provide a significant cost advantage.

The capacity in China’s aerospace systems to achieve (D), the big liquid engine system, is fairly low. It may require a long time of research and development to master. For (C), the vertical landing reusable system based on liquid propellant technology, will need some time to mature. As for now, the horizontal landing reusable system is considered as the fastest achievable technology, but demands highly capable personnel, and only a few teams in the world are known to be able to control it.

3. An accurate understanding of the market and customer needs

Below we offer a brief case study of small satellites clients:

The 2018-2020 period will see an augmentation of the launch of satellites. Demand, whether for the deployment of a single satellite, or a myriad of smaller ones, being high, will require fast launch cycles either with large or small engines spacecraft.

From 2020-2023, the demand will be focused on fast and low-cost launches. It will be dominated by large engine rockets deploying multiple satellites, or providing supplies and systems for overseas companies like SpaceX.

After 2023, parts of the satellites network will need replacement. The demand will be mainly focused on fast and accurate launches, where big engine and small engine spacecraft will have more differentiated usages and applications.

4. Long-distance ability

The company’s main business model (especially the big rocket) has a longer research and development cycle than other businesses. Before the product matures, it needs a stable environment and the capacity to continuously evolve, for example with the introduction of sub-orbital rockets, smaller launch vehicles, better self-controlled engines, etc. It can help the company refine its technology even further, or create much needed improvements and additions in critical moments. At the same time, the founders of the company need to have a strong ability to raise capital and gather resources in order to really make a difference.